Table of contents

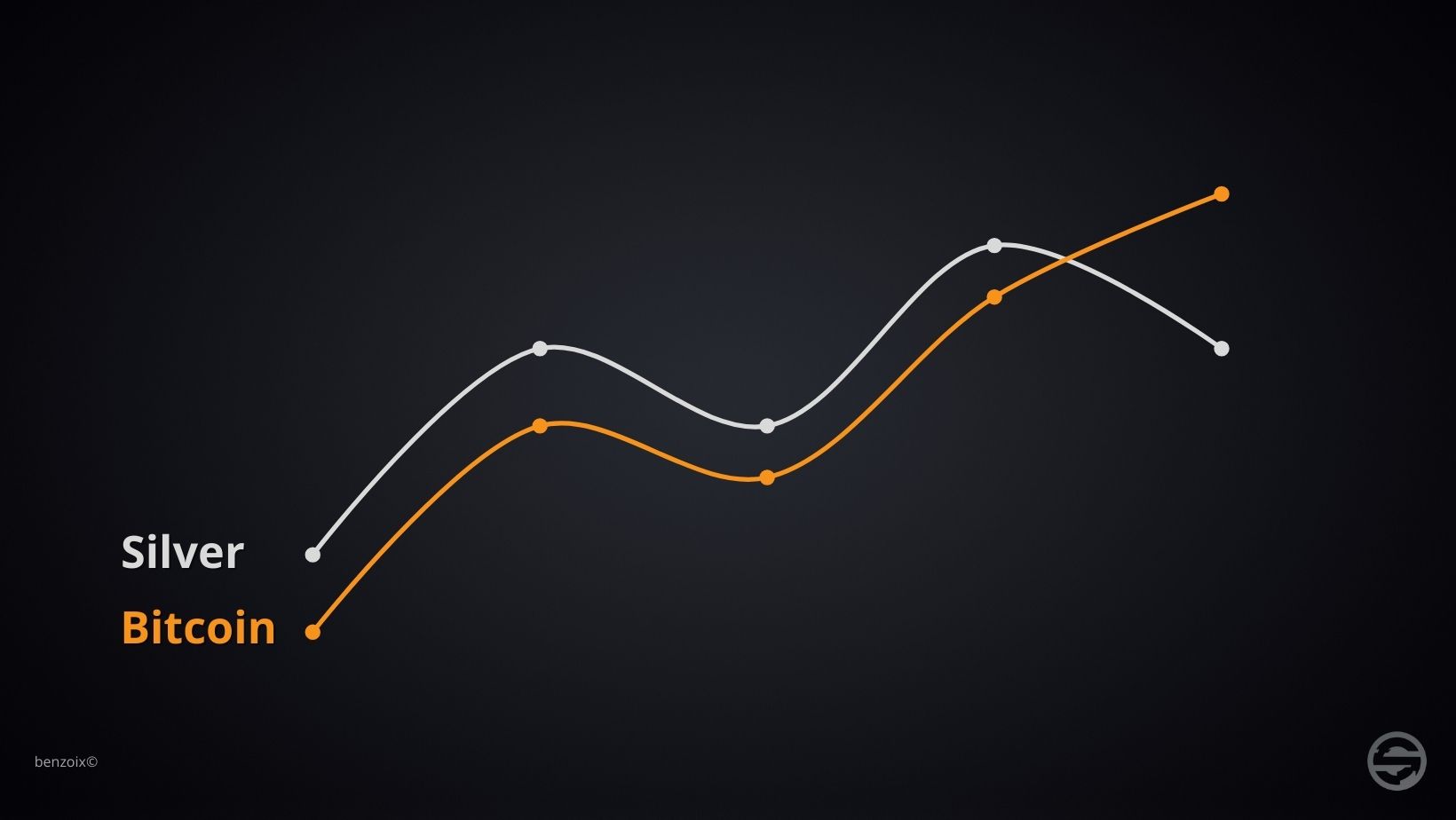

According to media outlet The Block, Bitcoin's (BTC) rise to become the second largest ETF commodity in the US marks a significant milestone for the Bitcoin market. According to the latter, this achievement is attributed to the growing demand from institutional and retail investors seeking exposure to Bitcoin. This view was also shared by Jag Kooner, Head of Derivatives at Bitfinex, who stated that "Bitcoin ETFs have exceeded silver ETFs in the U.S. in terms of size, driven by the substantial market interest they have received". He also points out that one of the reasons why Bitcoin spot ETFs have overtaken silver ETFs is that demand was expected to be strong, but had been unable to materialize until Bitcoin spot ETFs were approved.

In addition to the interest in Bitcoin spot ETFs, according to several media outlets, this event could also be explained by the conversion of Grayscale's GBTC into an ETF, bringing around $27.5 billion in liquidity to its launch and thus contributing to a significant increase in assets under management in Bitcoin spot ETFs.

Moreover, it's worth noting that several Bitcoin spot ETF issuers have offered very attractive management fees to attract investors. Some have even waived these fees for a set period. This strategy has undeniably helped propel Bitcoin spot ETFs to second place in the ETF rankings.

Finally, while there are a number of reasons why silver ETFs have overtaken Bitcoin spot ETFs, it's still a particularly remarkable achievement. On the one hand, because of silver's traditional status as a leading commodity investment. On the other hand, because of the recent nature of Bitcoin and the still limited understanding of its nature by the majority.

As a result, the rise of Bitcoin spot ETFs to second position testifies to a growing interest in Bitcoin on the financial markets, gaining credibility and recognition as an investment and portfolio diversification option.

- Sources:

- https://www.theblock.co/post/273317/bitcoin-surpasses-silver-to-become-second-largest-etf-commodity-in-the-us, consulted on 20.01.24

- https://cryptoast.fr/etf-bitcoin-spot-depassent-argent-termes-actifs-sous-gestion-etats-unis/, consulted on 20.01.24

Disclaimer : This is not financial advice. Satolix.io website aims to inform readers about Blockchain, Cryptocurrencies, and Web3. Any type of investment involves risk. Please conduct your due diligence and research the articles and projects presented on the site. Be responsible and do not invest more than your financial goals or means allow. In this regard, read our page : Warning about virtual currencies.

Some articles on the site contain affiliate links, and using them to register from the site allows the site to develop through the collection of commissions. By doing so, you also make yourself eligible for a welcome bonus, such as a voucher or fee reduction.

Bitcoin, Investment, Crypto, ETF

Bitcoin, Investment, Crypto, ETF 2024-01-21

2024-01-21